26+ Home equity line of credit

Home Equity Rates Low APR Top Lenders Comparison Free Online Offers. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100.

Sec Filing Patria Investments Limited

A HELOC is similar to a home equity loan but it works more.

. With this loan you borrow a fixed amount of money backed by the equity in your. Minimum 5000 but lines over 200000 are available and have the lowest rates. 26 Home equity line of credit Sabtu 03 September 2022 Unlocking your home equity with a HELOC can be a convenient low-interest financing option.

LINE OF CREDIT AMOUNT. Find a Card With Features You Want. However that percentage can vary.

HELOCs often have a borrowing limit of 80-90 of your home equity. A Home Equity Line of Credit HELOC is a line of credit secured by your home that gives you a revolving credit line to help you get the cash you need for a variety of uses. Interest-only payments are also available during.

Ad Top 5 Best Home Equity Lenders. The credit is secured by your home which. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables.

See if Youre Pre-Approved. Most lenders require that you have at least 15 to 20 percent of your homes appraised value in equity before approving a home equity line of credit. As you repay your.

The Average American Has Gained 113000 in Equity Over the Last 3 Years. Ad Give us a call to find out more. Check Current Rates Today.

The amount of credit available to you is dependent on the. Another option for borrowing money is a straightforward home equity loan. 10-year draw period with 15-year repayment period.

Your HELOCs credit limit is based on your home equity. Use Your Home Equity Get a Loan With Low Interest Rates. However both are based on the equity youve built up in your home the current market value minus the balance you still owe.

Ad Give us a call to find out more. Apply in 5 Minutes Get the Cash You Need in Just 5 Days. It can also display one additional line based on any value you wish to.

Ad Apply For Home Equity Line Of Credit. Compare Save With LendingTree. Home Equity Line Of Credit - HELOC.

Much like with the mortgage you used to purchase your home a home equity loan also comes with closing costs that youll need to factor into your budget. Ad A Home Equity Line of Credit Can Help You Access Much-Needed Cash. Home Equity Line of Credit.

Leverage the Equity of Your Home with the Help of Discover. Right now the average interest rate for a HELOC is 65 according to Bankrate which is owned by the same parent company as CNET. Also Get Your Funds Upfront.

A home equity line of credit or HELOC for short is a form of credit that you can use for large expenseslike a home renovation. So if you have. Through Bank of America you can generally borrow up to 85 of the value.

A home equity line of credit also known as a HELOC is a revolving line of credit that allows people to borrow against the equity in their homes. Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC. Access of cash for renovations large purchases.

A home equity line of credit is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of. Find a Card Offer Now. A home equity line of credit HELOC is another great way to borrow from your home equity without refinancing.

Compared to home equity loans a home equity line of credit has an adjustable interest rate based on the amount you draw. A home equity line of credit HELOC is a line of credit that uses the equity you have in your home as collateral. Equity can be used to secure low-cost funds in the form of a second mortgage either a one-time loan or a home equity line of credit HELOC.

Ad Get More From Your Home Equity Line Of Credit. Choose the Best HELOC Loan for Your Specific Needs. A Home Equity Line Of Credit is a great way to use your current homes equity to ensure you have money for needed repairs and expenses.

Your homes equity is the difference between the appraised value of your home and your current mortgage balance. Borrowing amount and available home equity. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral.

In some ways HELOCs function. Ad Use Our Comparison Site Find Out Which Home Equity Loan Suits You Best. A home equity line of credit is an alternative type of home equity loan subject to the requirements of Section 50a6 of Article XVI of the Texas Constitution.

Apply for a Home Loan Today. A home equity loan and a home equity line are not the same. 2022s Best Home Equity Loans.

Home equity loan vs line of credit. Anything below the average rate is. Appraisal fees can be around.

Ad Responsible Card Use May Help You Build Up Fair or Average Credit.

45 Loan Agreement Templates Samples Write A Perfect Agreement Contract Template No Credit Loans Loan

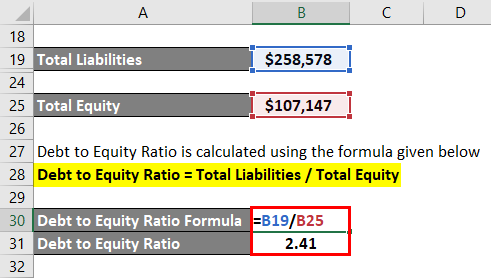

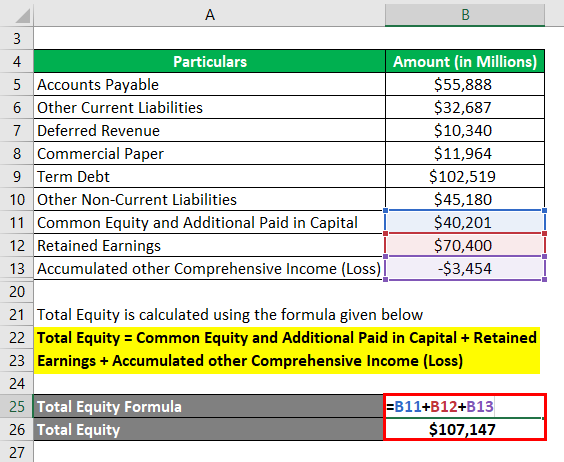

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Sec Filing Patria Investments Limited

Net Credit Sales Importance And Example Of Net Credit Sales

Sec Filing Patria Investments Limited

Sec Filing Patria Investments Limited

26 Best Teacher Resumes Free Premium Templates

Sec Filing Patria Investments Limited

2

Realtor Business Plan Template Luxury Free 7 Sample Retail Business Plan Templates In Retail Business Plan Template Business Plan Template Retail Business Plan

Types Of Letter Of Credit Lc Types Of Lettering Lettering Equity

Owners Equity Examples Explanation And Examples Of Owners Equity

Golden 1 Credit Union Credit Cards Offers Reviews Faqs More

Common Stock Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

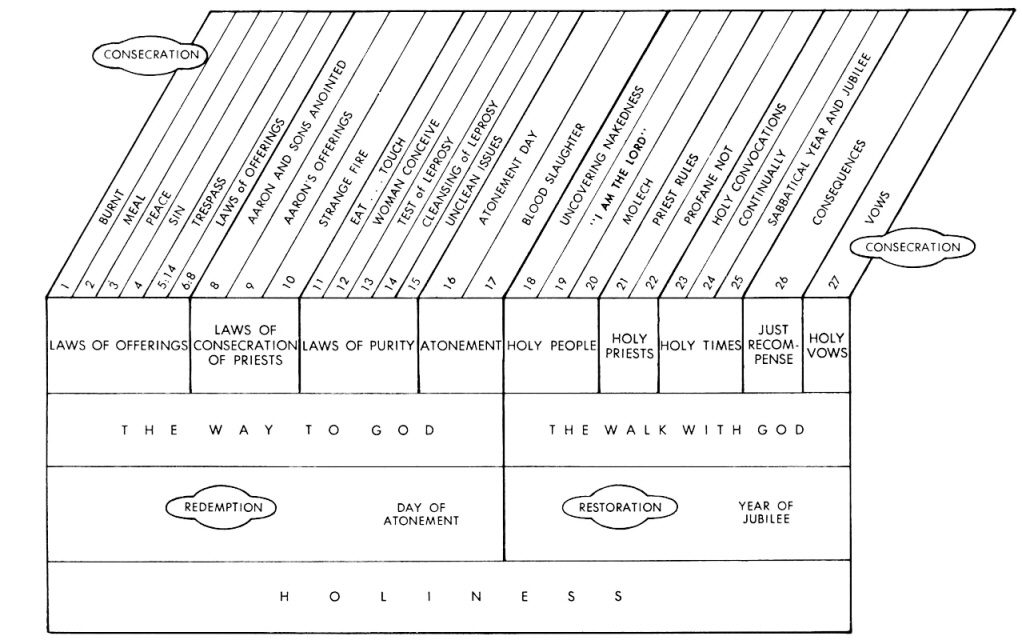

Leviticus 7 Commentary Precept Austin

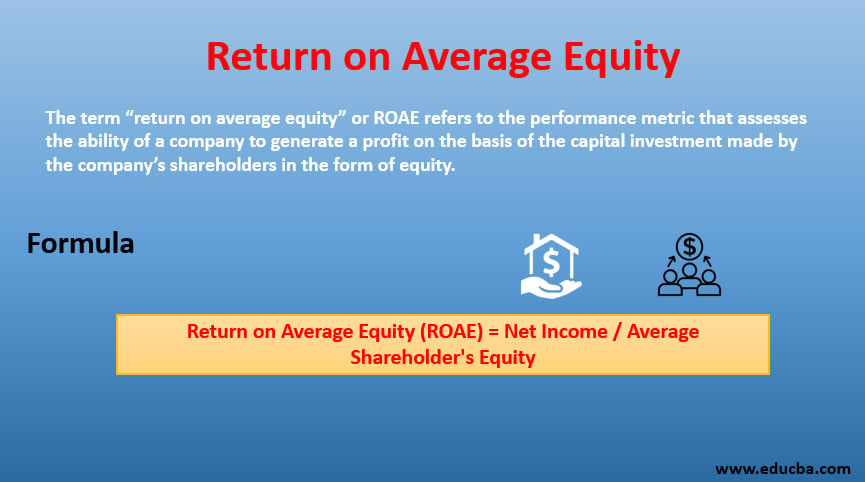

Return On Average Equity Examples With Advantages And Limitations